| COVID-19 Pandemic

The Coronavirus pandemic began to shut down virtually all aspects of normal life. Many industries are faced with the challenges of a possible coming economic crisis. However, as countries begin to reopen their economies it seems as if the Business Jet market is recovering.

The business aviation sector has not proven immune to the fallout, even if it usually benefits from times of disruption, when business travellers turn to private charters to fill the gaps left by restrictions on commercial aviation.

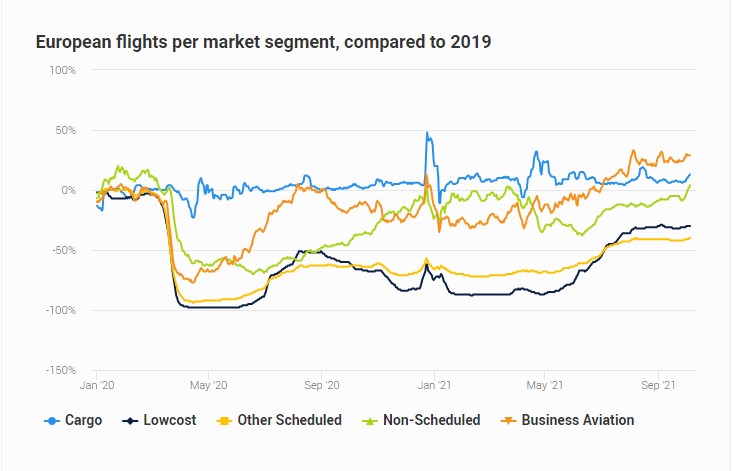

Worldwide business jet flight fell approx. 79% in the first two weeks when the pandemic took over Europe, just over 26,000 flights were operated during the period. Activity in America and Europe broadly reflected that global trend, while business jet flight activity out of Asia and Africa fell between 65-70%, flight activity out of China was down by 57%. In all, just under 1,000 business jets were active worldwide in the first half of April, compared to over 4,000 in the corresponding period the year before.

However, while commercial airlines grounded service over the past two years, wealthy and business leaders were still able to travel safe. As a result, sales and consumption within private jet has increased, especially in 2021.

| Analysis Department

World Jet Trading is experts in analyzing the market for Business Jets and provide a professional overview of the current market situation, or the trends for a specific model.

What is necessary is a complete picture and understanding of the historical aircraft market, a detailed knowledge of the current aircraft sales and purchase landscape combined with an understanding of the trends in the general economic climate. With this knowledge it is possible to make surprisingly precise forecasts regarding prices and trends, model by model within the aircraft marketplace. Thus, the savvy aircraft purchaser knows when it is time to make a move into the market several months in advance.

By closely following the market and being in direct contact with aircraft owners on a daily basis, and having a dedicated analysis department, World Jet Trading always has this knowledge.

The internal data World Jet Trading has collected originates back to 1978. These data are matched with the global macro economy since the production of corporate jet aircraft starts in 1962.

World Jet Trading Analysis Department Team

The World Jet Trading Analysis Department has a wide range of dedicated staff members. With academic backgrounds ranging from Business Law and Economics to Business, Asian Language and Culture as well as background within Aviation, the Analysis Department team is able to share and combine knowledge to provide the most comprehensive analysis of the business aircraft market.

Furthermore, with some having much experience within the aviation industry, World Jet Trading has established good training for all members of staff to facilitate knowledge sharing so that everyone can get a great insight in the private aviation market.

Analysis Department’s Effect When Selling and Purchasing

Having an analysis department regularly retrieving real time data from the market and processing it has a great sale and purchasing advantage.

Analysing the data from the current market of other aircraft owners during a sale allows World Jet Trading to set a good and realistic price level of the aircraft. This results in a significantly lower sales period.

In addition, during a purchase of an aircraft World Jet Trading Analysis Department will analyse other aircraft of the model and make currently in the market. By analysing this World Jet Trading can provide the best aircraft to the best price in relation to the needs of the customer.

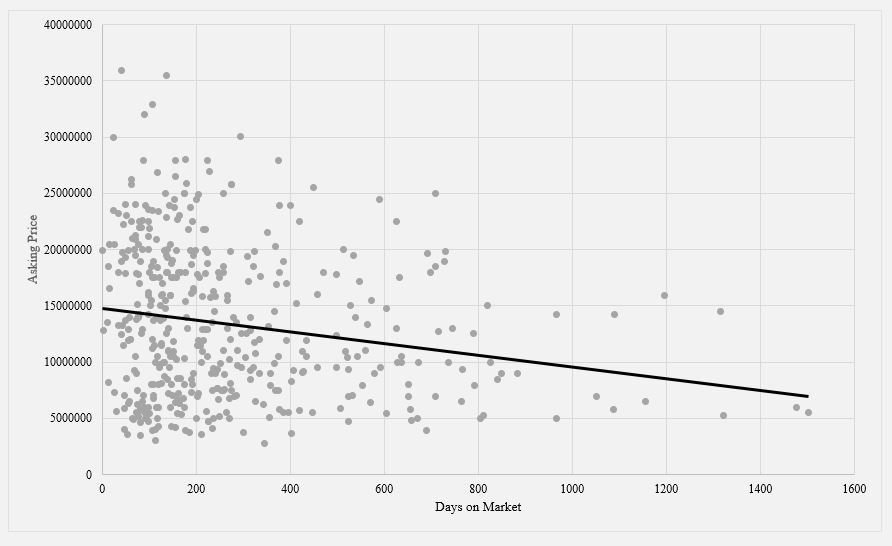

Having a constant eye for the macro-economic movements in relation to the private aircraft market World Jet Trading Analysis Department is able to analyse and predict the movement of the market. The selling period, or Days on Market, pricing levels and the number of aircrafts for sale are greatly influenced by the macro-economic movements. Using historical data World Jet Trading Analysis Department is able to analyse the correlation of macro-economic movements and the market, in order to provide our customers with the most precise predictions during a sale or purchase.

Aircraft price evaluation content

1.Conclusion

- True value of the aircraft

- Aircraft overall status and maintenance

- Market opportunities

2.Used market situation

- Supply and demand evaluations

- Overview of the current market for the respective aircraft model (amount, prices, S/N, time/ hours etc.)

- Where is your aircraft in the global market?

- Off market research

- Information on similar/ competitive models, which can affect the price and possibility of selling.

3. Individual aircraft specifications examination

- Aircraft price depreciation evaluations

4.Manufacture comparison in the large cabin category (Embraer, Gulfstream, Bombardier and Dassault Aviation).

- Competitive situation and US dollar market share and exchange rate

- Deliveries over the years and accumulated/ total deliveries

- Similar aircraft models comparison (range, speed, volume, payload, average asking price etc.)

5. Why the Bluebook price isn’t the true value

- Examples of Bluebook miscalculations

- What Bluebook does wrong in their aircraft price evaluation

6. Macro economical observations in the business jet market and in general – global aircraft market trends (including price reduction patterns/ announcements etc.)

- Broker price indication – where are the prices heading according to the brokers themselves

- Customer interest survey – How has the number of inquiries developed

- Leading indicators – where is the global financial market heading

- The macroeconomic indicators specific influence on the general market price

- Short comments on other macro economical situations and predictions on their effect on the aircraft market

Analysis Department Helps You Find the Right Price

When purchasing an aircraft there are several factors that needs to be taken into consideration. Comparisons in range, operation costs and other performance measurements has to be conducted between different make and models to find the one that fits your needs.

Pricing is another factor in which several circumstances has to be evaluated. Airframe total time, maintenance cycle and days on market, are examples of the factors influencing price level. Knowing these factors influence on the price is key in order to secure a good aircraft for the right price or sell at the right time before the price level drops.

Market Fluctuations and the Effect on the Business Aircraft

In the analysis department at World Jet Trading, we continually follow the fluctuations in the stock market as well as the macroeconomic indicators. Generally, the aircraft market prices adjust quicker than most other products to fluctuations in the market. Predicting the general aircraft price’ adjustment to the market is therefore essential in providing the best price when purchasing an aircraft.

In addition, when selling an aircraft, it is essential to predict the consumer interest in a such aircraft. Through historical and contemporary data on the market, World Jet Trading is specialised in calculating the aircraft prices and consumer interest in relation to the market fluctuations.

World Jet Trading ApS | Frederiksgade 1 1265 Copenhagen K Denmark | Tel +45 33 133 133 | Fax: +45 33 133 122 | Mob +45 40 733 133 | wjt@worldjettrading.dk